Whim.Bet: A System for Real-Time Economic Capture of Livestreams

April 2025

By Whimsy K.

Abstract

There is a layer of the internet we have yet to capture. Not its information. Not its content. Its pulse. Over 7.5 billion hours of livestreams are watched every month across platforms like Twitch, YouTube Live, and Kick. Streaming now commands over $150 billion in annual economic activity—through subscriptions, sponsorships, tips, ads, and merch. But viewers—the emotional engine of this economy—earn none of it. Each viral moment, rage quit, clutch play, or unexpected kiss generates a massive spike in attention. Billions feel it. No one monetizes it.

Whim.bet proposes a simple idea: What if you could trade culture as it happens?

By combining autonomous emotion detection with the structural mechanics of Azuro's Virtual Liquidity Tree, Whim.bet converts fleeting audience reactions into liquid, on-chain prediction markets. It doesn't bet on the future—it indexes the moment. It monetizes live volatility. It captures reflex. We are not here to watch history unfold. We are here to trade its heartbeat—as it happens. In a world moving faster than cognition, Whim.bet introduces the first economy of presence. The future doesn't belong to those who predict. It belongs to those who react.

In 2015, Twitch averaged around 500,000 concurrent viewers globally . By 2024, this number exceeded 6.5 million concurrent viewers at peak hours, representing an over 1200% growth in less than 10 years. YouTube Live, Kick, Facebook Gaming, and decentralized streaming protocols are similarly accelerating, with global livestream content consumption increasing by 18% year-on-year.

The livestream economy today commands over $150 billion in aggregate annual economic influence — encompassing subscriptions, donations, sponsorships, merchandising, and derivative media.

Yet the viewers, those whose attention and emotional energy create this economic engine, are structurally excluded from participating in the upside of the moments they make valuable.

Today, viewers can tip. They can subscribe.

But they cannot capitalize on the reflexive, real-time cultural volatility they co-create.

There exists a massive latent market:

Each such moment generates volatility — but that volatility is not yet liquid.

In an era defined by the convergence of livestream media, autonomous systems, and speculative behavior, Whim.bet introduces a new class of real-time market infrastructure. This protocol does not merely reflect events; it anticipates them by operationalizing a unique input signal: proximity.

Unlike traditional prediction markets that rely on deterministic oracles, Whim.bet interprets emotional density in crowds—manifested as shared attention during livestreams—as the substrate for market creation. This system is formalized in a new AI-native protocol architecture we call the Autonomous Proximity Prediction Protocol (A3P).

Whim.bet is a protocolized reflex economy—capable of sensing when something is about to happen, before the event, and then generating liquid markets around the feeling of imminence itself.

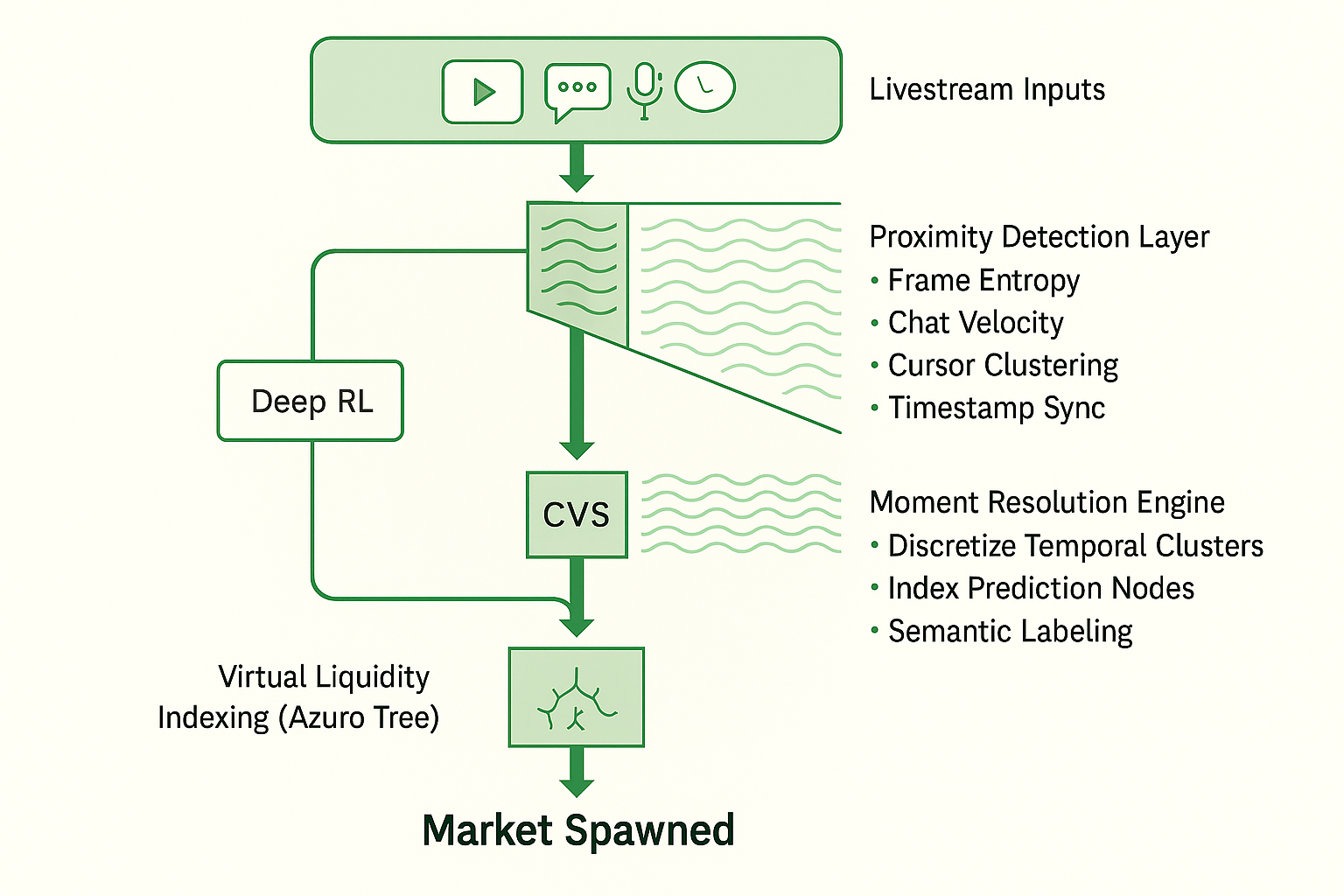

A3P operates as a three-layer autonomous pipeline. Each layer performs an essential function: detecting, interpreting, and instantiating reflex into structured prediction markets.

A3P begins with a philosophical provocation: proximity is the most underutilized signal in networked systems. In physical marketplaces, proximity implies intention—eyeballs translate to footfall, and footfall becomes price movement. On the internet, this signal has been diluted or ignored in favor of click-throughs and static telemetry.

But in livestream contexts, proximity reasserts its power. When thousands of users converge—watching the same frame, reacting in chat, syncing unconsciously in their anticipation—a latent consensus forms. A3P interprets this consensus as pre-volatility.

Proximity, under A3P, is not spatial. It is temporal-emotional density, quantified and made computationally tractable.

This is the system's perceptual interface with culture. It monitors:

Frame entropy: quantifying visual turbulence in livestream data

Chat burst velocity: capturing reaction speeds in mass text expression

Cursor clustering: an opt-in signal from browser extensions, tracking gestural convergence

Timestamp synchrony: alignment of collective watch positions

These are integrated into a unified metric: the Cultural Volatility Score (CVS). CVS is continuously updated and modeled as a dynamic signal field—akin to an electroencephalogram of the stream's nervous system.

To formalise the Cultural Volatility Score:

Then we can define CVS as:

\[ CVS(t) = \beta_1 F(t) + \beta_2 V(t) + \beta_3 C(t) + \beta_4 T(t) \]When CVS breaches a critical threshold, the system transitions from detection to structuration.

The system is agnostic to outcomes. It does not predict what will happen. It formalizes the shared intuition that something might happen. It prices attention, not information.

Market instantiation occurs via Azuro's Virtual Liquidity Tree model. This allows each predictive moment to be instantiated as a market node with inherited capital depth.

Whim.bet avoids traditional Automated Market Makers (AMMs). Instead, it leverages proximity-induced capital reallocation, where liquidity dynamically scales with emotional temperature.

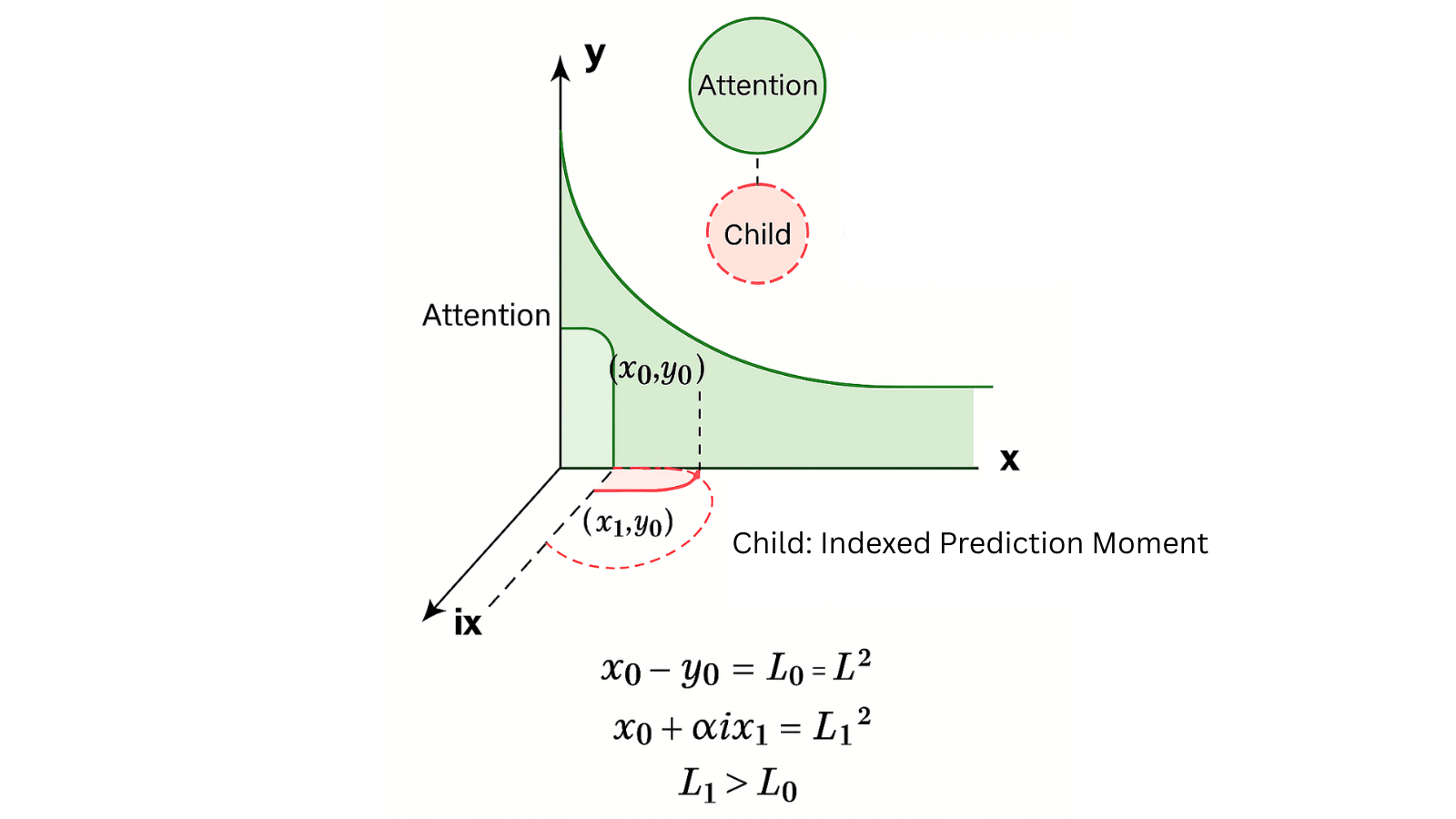

The liquidity depth LLL at any market node is governed by:

\[ \begin{align*} &\bullet\quad x_0, y_0 \text{ are the reserve weights of the parent attention pool}, \\ &\bullet\quad ix_1 \text{ is the indexed volatility along the emotional axis}, \\ &\bullet\quad \alpha \text{ is a weighting coefficient based on cultural salience}, \\ &\bullet\quad L \text{ is the total market depth}, \\ &\bullet\quad L_1 > L_0 \text{ reflects how emotional spikes unlock deeper liquidity}. \end{align*} \]

The result is a new prediction moment, dynamically indexed from the parent pool. This branching event forms a child market, backed by its own virtual fund but mathematically linked to the parent.

This graph visually demonstrates Azuro's liquidity innovation:

Parent LP (x-y curve) behaves like a traditional Uniswap-style AMM. The Child LP (ix-x plane) introduces a second dimension (ix), effectively indexing liquidity based on prediction context (like a market or match).

Together, they form a 3D liquidity model — increasing flexibility, reducing capital inefficiency.

This allows for dynamic capital redistribution based on real-time emotional thermodynamics—a design that mimics the organic liquidity of human attention.

There is no need for external governance or manual intervention. The market is not just created because of crowd behavior—it is created by it.

In this sense, A3P does not merely detect cultural volatility. It converts reflex into structure, feeling into futures, and collective nervousness into programmable liquidity.

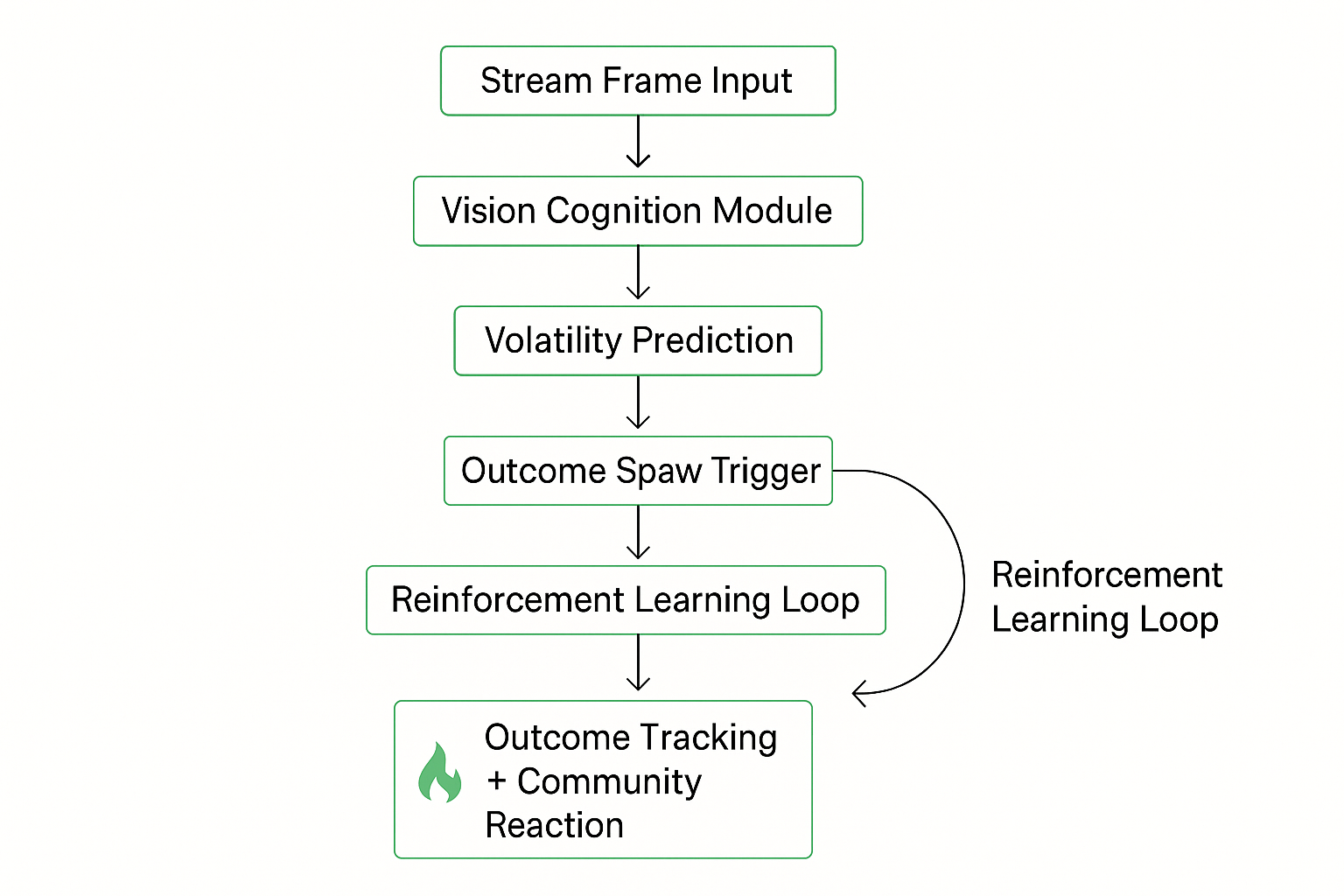

IV. Vision Cognition & Reinforcement Adaptation

Beyond cultural signal parsing, A3P integrates an adaptive vision cognition module. This module continuously watches livestreams, learning to identify visual context such as clutch plays, rage quits, or onscreen momentum shifts through frame-by-frame analysis.

Unlike traditional classifiers, this system improves with every cycle. It uses reinforcement learning—rewarding itself for correctly aligning visual signals with high-volatility market moments. The more it's used, the smarter it becomes.

This addresses a known AI limitation: generalization. Most models fail when confronted with entirely unfamiliar games or unseen livestream formats. Whim.bet's system, however, does not rely on pretrained domain-specific models. It generalizes through interaction.

It learns from:

Over time, it becomes an adaptive reflex engine, capable of embedding itself into the logic of any game, format, or livestream.

Agricultural volatility gave birth to commodity futures. Corporate risk gave birth to equity markets. Macro uncertainty gave birth to derivatives. Information asymmetry gave birth to prediction markets.

Today, the primary volatility source of the internet, cultural reflex, remains unpriced.

But as livestreaming continues to grow, as emotional collective moments increasingly define relevance and virality, the pressure to financialize this layer will become irresistible.

Whim.bet is positioned not as a product, but as an infrastructure inevitability. A necessary evolution of digital markets. When presence & attention becomes more valuable than information, when reaction speed becomes more decisive than knowledge depth, the first financial system to structure and trade presence will command the frontier. Whim.bet is that system.

It does not seek permission. It is built to absorb the pulses of the internet itself, and in doing so, create a new economy whose underlying asset is emotional reflex.

In a world where everyone watches together, Whim.bet lets them speculate together — at the speed of collective feeling.